unlevered free cash flow vs levered

Levered cash flow vs. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered free cash flow is the amount of cash a company has prior to making its debt payments.

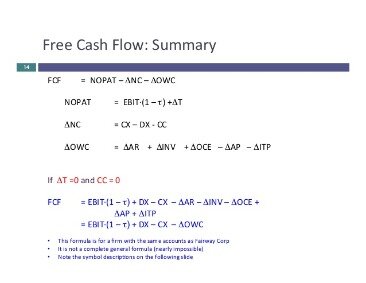

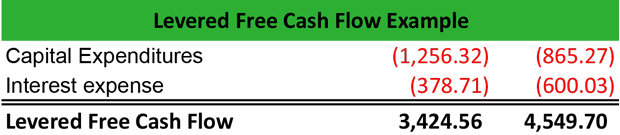

. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF EBIT 1-tax rate DA ΔNWC CAPEX. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Includes interest expense but NOT debt issuances or repayments.

There is another way that you can calculate free cash flow. Like levered cash flows you can find unlevered cash flows on the balance sheet. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

Includes interest expense and mandatory debt repayments but opinions on this differ. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors.

Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. A DCF valuation will not directly apply a levered free cash flow metric into its formula as it uses unlevered free cash flows as the proxy for estimating an assets value. Cash Flow from Operations CapEx.

Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders. Unlevered Free Cash Flow 234265 237055 Use of Non-GAAP Financial Measures. To better track your finances youll want to make sure you use trusted accounting.

Enterprise value is a measure of the companys. FCFE 5000 500 200 -770 -2750 -550 1630. In our earnings press releases conference calls slide presentations and webcasts we may use or discuss.

Levered and unlevered free cash flow are concepts that stem from the term free cash flow. Using the figures for Company A and assuming the firm has a debt repayment of 550 we can calculate the FCFE as. Its principal application is in valuation where a discounted cash flow DCF model DCF Model Training Free Guide A DCF model is a specific type of financial model used to value a business.

On the other hand Unlevered Free Cash Flow provides a more attractive number of free cash flow than Free Cash Flow and Levered Free Cash Flow since it excluded interest payments. Understanding Levered Vs Unlevered Free Cash Flow Discounted Cash Flow Analysis Street Of Walls What Is Free Cash Flow Calculation Formula Example Share this post. Levered cash flow is the amount of free cash available to pay dividends the amount of cash available to equity holders after paying debt In some models analysts will use leveraged free cash flows as only.

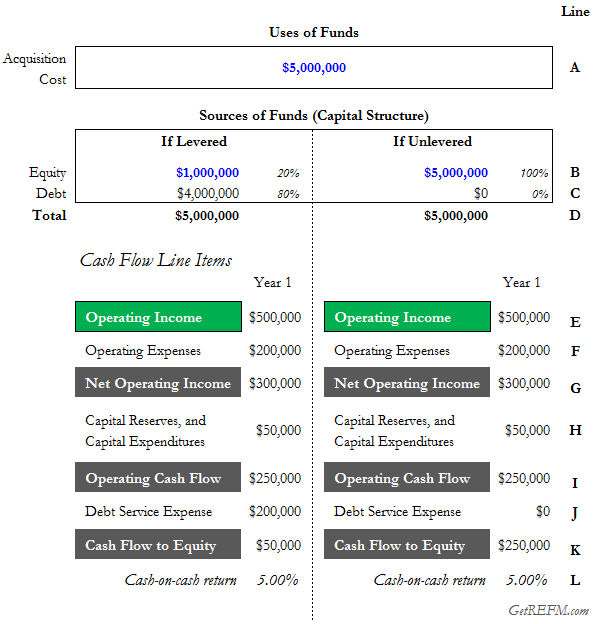

Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable. Unlevered cash flow is the amount of cash that a property produces before taking into account the impact of loan payments. What is Levered Free Cash Flow.

Levered cash flows indicate a companys cash flow post-interest expense. The most important application of these concepts is when calculating return metrics like cash on cash. Free cash flow Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including operating expenses interest payments etc.

Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. Levered free cash flow is the amount of cash a business has after paying debts and other obligations.

Unlevered cash flow represents the money you have before paying all those bills. Unlevered free cash flow is the gross free cash flow generated by a company. The difference between UFCF and LFCF is the financial obligations interest and principal.

Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. Thus a positive LFCF illustrates a companys ability to cover all financial obligations distribute dividends and grow. It is also thought of as cash flow after a firm has met its financial obligations.

Levered free cash flow shows the amount of funds that are left over once debt and interest on debt are paid. Levered free cash flow is often considered more important for determining actual profitability. Unlevered cash flow is the amount of.

Its a better indicator of financial health. Levered Free Cash Flow. This gives us a sense of how the companys cash flow profile develops over time.

Plus to make a comparison between companies UFCF is more favored. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. This is because a business is liable for paying its debts and expenses in order to generate a profit.

Levered cash flow is the amount of cash that a property produces after operating expenses and debt service. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Net Income Depreciation.

Unlevered free cash flow is important to financial health because it highlights the gross cash amount. The key difference between Unlevered Free Cash Flow and Levered Free Cash Flow is that Unlevered Free Cash Flow excludes the impact of interest expense Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Start from first principles.

Therefore we can derive levered. Unlevered free cash flows indicate a companys cash flow pre-interest expense. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Unlevered Free Cash Flow. That means that Joe has 479000 in free cash flow that can be used in his business. Excludes interest expense and ALL debt issuances and repayments.

The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. Proper financial management for small businesses will put you in a better position to secure loans and grow your company. Difference Between Levered And Unlevered Free Cash Flow.

Unlevered cash flow vs. FCFE EBIT - Taxes.

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Understanding Levered Vs Unlevered Free Cash Flow

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Wave Accounting

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Ufcf Lumovest

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Levered Free Cash Flow Definition Meaning Example

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial